Golf Course Loan Applications - Get it Right the First Time

Start the Golf Course Loan Process by Lining here:

PLEASE AKE A FEW MOMENTS TO REVIEW THIS DOCUMENT WITH MY COMPLIMENTS

Remember my free consultation. Mike Kahn:

Email: mike@golfmak.com

In my experience, golf course loan applications are turned down because the borrower is unprepared to deal with the lender. Believe me, we've worked with big banks, local banks, insurance companies, Textron Financial, FMAC (now defunct), and even private sources. Far too often, the loan request is vague, incomplete, or unrealistic. Some of our failed borrowers were golf course owners trying to consolidate debt. Other failed applications were from aspiring golf course buyers lacking experience in the business. We've watched borrowers naively pay origination fees of $25,000 or more to lenders and brokers with absolutely no hope of getting funded.

I felt this article might be more helpful if I indicate the reasons golf course loans are turned down. Here's my short list:

1. Loan to value (LTV) is far too high. DSR too low (financially dangerous)

2. Not enough verifiable information about the subject property delivered with the application

3. Borrower refuses to provide personal signature on loan (wants lender to take all the risk)

4. Borrower has little or no experience managing golf courses

5. Financial history of subject golf course not strong enough

If you are ready to start the golf course finance process, click here.

BEWARE OF LARGE UPFRONT FEES!

1) Loan to value (*LTV) is far too high. Debt service ratio (**DSR) is far too low.

*LTV: Loan amount as percentage of the total appraised value or purchase price.

Example: Purchase price of $5,000,000, loan amount $3,750,000, Loan to Value (LTV) 5,000,000/3,750,000 = 75%.

**DSR: Net Operating Income (NOI) divided by annual debt service.

Example: earnings or NOI = $500,000, annual debt payments = $325,000. 500,000/325,000 = 1.54 Debt Service Ratio.

DON'T EXPECT THE BANK TO TAKE ALL THE RISK - No skin. No loan!

Golf course buyers too often look for unrealistic loans. It's because they're not bringing enough money to the table - they are trying to buy a golf course they cannot afford. I have stated elsewhere on this web site that (in 2002-6) a golf course buyer should have a minimum of 35% cash to put down on a golf course and still have plenty of operating capital on hand after the close.

A person buying a $5 million dollar golf course at 10 X earnings (earnings of $500,000) needs $1.75 million in cash and at least $300,000 in operating capital (in cash) available the day of possession. At today's 8% interest rates, amortized over 20-years, annual debt service is approximately $326,211, a safe 1.5 DSR. By showing reasonable operating capital. This loan will very likely be successful. Note 2006: Fixed rates for golf courses in 2004 are in the 7% to 9% range. The DSR and LTV formula, in my opinion, remains the same.

Bankers and lenders need to see the borrower taking risk ('skin in the game'). Trying to get a banker to take all the risk will just waste everyones time.

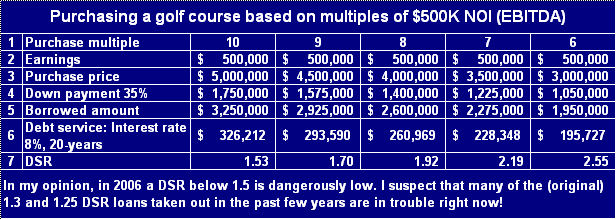

You'll see the LTV varies inversely to the purchase multiple. Below we set the loan rate at 8% over 20-years for illustration purposes. Today's 20-year rates (2006) are being quoted 7% to 9% fixed.

Obviously, buying at 6 X earnings shows the best (healthiest) DSR.

2) Not enough (verifiable) information about the subject property.To process a loan the fastest way possible, be prepared to provide all the information the lender needs with the loan application. Every item must be verifiable, so be sure your source of data and information can be easily referenced. Be aware that lenders may ask for items not listed below.:

- Personal financial statement

- Borrower's personal background, or resume

- A property description including exact location, when built, architect, yardage, cart paths, acreage, square footage of buildings, etc.

- A list of all fees, dues, menu prices, etc.

- Marketing materials, brochures, menu, score card

- A property history - known previous owners, historical highlights

- A recent property appraisal

- A detailed 3-year cash flow history

- List of accounts payable

- A list of accounts receivable

- Financial statement with balance sheet

- Bank statements up to three recent years

- Statement of use of funds 12.

- A detailed history of rounds played

- A membership list

- A recent market analysis

- A complete equipment inventory (serial numbers of large machinery)

- A complete merchandise for resale inventory

- Copies of insurance policies, tax returns

- Copies of all permits and licenses

- List of all debts

- Loans and leases

- Environmental surveys

- Source of irrigation water, consumption rates, and up-to-date permits

- Proof of compliance for storing items like fuel and chemicals, etc.

- Engineers structural report on all buildings

- Termite inspection report

- Agronomy report on the golf course

- An up-to-date property survey

- A business plan going forward

- A summary of key personnel -including salaries, job descriptions

"In my experience loan applicants don't begin gathering the above information until after the application has been presented. By not having this information readily prepared, weeks, or even months will be lost. Many of the above items take time to obtain: appraisal - two weeks to a month, survey - up to two months, financial statements - several weeks, engineers structural inspection - up to three weeks, market analysis - two weeks, agronomy report - up to a month."

Be sure the information you present to the lender is stated on professional letterheads - accountant, banker, appraiser, surveyor, engineer, etc. Attach the source business card where possible. If the information shows up on your own stationary, the lender may 'red flag' the application.

"All you need to do is imagine yourself as the lender for a few minutes. Think about what you would want before you take a 75% risk on a golf course property for a virtual stranger!"

Money in 60-days or less! It is possible to achieve a golf course loan in less than sixty days provided you have the information available for the lender in a timely manner.

3) Borrower not willing to provide a personal signature on a loan (wants lender to take all the risk).

Too many golf course loan applicants want the lender to accept 80% to 90% of the risk. Can you imagine buying a golf course and asking a lender to provide an 80% to 90% loan without the borrower accepting the slightest risk. Not likely.

During the inflationary period of the 80's, many lenders were comfortable when property values were increasing by the minute. That is not true today. If you want to own a golf course in this 2004 world, you need to be prepared to jump in with both feet - financially and with energy.

Five to ten years ago a 65% golf course loan would not have required a borrower's personal recourse (signature). In 2006, lenders are looking for a greater commitment from the golf course borrower. This demand knocks many golf course hopefuls right out of the game.

A STRATEGY WE PROPOSED - "I participated in a funding last year where the lender required the borrower's personal guarantee. We negotiated the borrower's signature to 50% of the note - figuring the property would always be well worth 1/2 the appraised value. In that case, the borrower had sufficient financial strength, experience in golf, and was not at full risk for the loan amount."

"I believe you need to be prepared to sign personally on a golf course loan."

"With preliminary information about a golf course I can estimate what you can expect a course can support in debt. Write Mike@Golfmak.com for a complimentary consultation."

4) Borrower has little or no experience in golf course operations.A first time golf course buyer may have a problem with a golf course loan application - especially if the LTV is more than 65%. Many experienced golf course lenders (like Textron Financial Corporation) want to see their borrowers with a reasonable amount of experience in the golf course business.

"One way around the lack-of-experience issue is to include an experienced golf course person in the executive summary in the business plan. Some of my clients have placed me on the management team in their business plan. An experienced person on your team gives the lender greater confidence in funding a golf course. You may also find yourself with better terms because: Experience lowers the lender's risk." Mike Kahn

5) Subject's recent revenue history not enough to carry debt.

In 2006 and the coming year you can expect lenders to shy away from golf course loans if the trailing 36 month cash flows indicate an inability to carry the proposed debt. Golf course loans are considered business loans by bankers. Therefore, even if the property is being purchased for less than 1/2 appraised value, the lender's decision will only be based on the ability of the 'business' to service the debt.

Note: Not all is lost when a course shows poor earnings and cannot get financing! "We came into a loan situation as consultant for a golf course with a poor history of earnings. It's current loan was being recalled and no lender was interested. We accepted a short-term management contract to put the business on an earnings track. We successfully reestablished and implemented an operational business plan that a major lender accepted. Not only did we achieve a new loan, but we increased funding from $5.2 million to $5.6 million - $.4 million more than the note being recalled. I remained for a period with the club in an advisory capacity (far less expensive than a management contract - and they have my expertise on the team throughout the term of the loan)." See: Case study

If you're buying a 'fixer-upper' that has a recent negative cash flow history, be prepared to sign personally - and possibly be asked to put up additional collateral. Call your rich uncle!

Even with 50% down payment - it failed: "I recently watched a 50% LTV golf course loan refused, because the subject property had an unprofitable trailing 36-month history."

BEWARE OF UPFRONT FEES! DO YOUR HOMEWORK.

Brokers and loan origination sources often ask for upfront fees to begin the golf course loan application process. I believe you shouldn't be paying large upfront cash to brokers or lenders without strong assurances that your application will be successful. You may need to pay a small underwriting advance, sometimes from $2,000 to $5,000. However, by doing your homework before you begin the loan application process (assembling the 31 items or more above), you will have a pretty good view of your chances of success.

I can help you assess your chances for success. Call me: 941-739-3990.

"Remember, the lender really wants to loan you the money. There is a very high likelihood that you will achieve a loan commitment if you have all the materials for the lender's comfort. Red Flags (as I call them) are issues where the borrower cannot answer the lender's questions about items, or the material cannot be easily referenced by the lender. Any show of vagueness, uncertainty, naivety, or lack of experience will tend to frighten a lender away."

DISCLAIMER: The above article is provided by Golfmak, Inc. President, Michael A. Kahn, as a complimentary service and guide to readers. Michael Kahn takes absolutely no responsibility for results.